Originally written for Capital Group by Darrell R. Spence, Pramod Atluri and Bradford F. Freer

Edited for brevity and clarity by Gleba & Associates

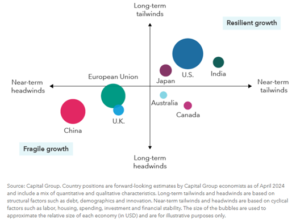

The United States, flexing its muscles as the world’s largest economy, is once again serving the critical role of global growth engine. As Europe and China struggle with weak economic activity, the U.S., India and, to a lesser extent, Japan are showing signs of resilience as the major players in the world economy diverge.

Despite higher interest rates and elevated inflation, the International Monetary Fund is predicting the U.S. economy will expand this year at more than twice the rate of other major developed countries. The IMF recently raised its forecast for U.S. growth to 2.7%, compared to 0.8% for Europe. Moreover, the power of America’s consumer-driven economy is helping to support growth in the rest of the world as well.

“People used to say if the U.S. sneezes, the rest of the world catches a cold. The opposite can also be true,” says Capital Group economist Darrell Spence. “When it’s firing on all cylinders, the U.S. can help other export-oriented economies.”

U.S. and India generate strong tailwinds for the global economy

Spence is more optimistic than the IMF. He believes the U.S. economy will grow at a rate closer to 3.0% this year as consumers continue to spend, the labor market remains tight, and manufacturers invest in newly diversified supply chains. Meanwhile, recession fears — widespread just a year ago — are no longer a given.

“Most people would have thought that after the Federal Reserve raised interest rates as aggressively as they did, the U.S. would be in the middle of a recession right now,” Spence adds. “It is surprising, to myself included, that we haven’t seen more economic weakness.”

Inflation is falling but stalling

Looking ahead, much depends on the path of inflation. The U.S. economy has continued to grow in the face of elevated inflation and a federal funds rate currently at a 23-year high. It now sits in a range of 5.25% to 5.50%, up from near zero roughly two years ago.

The Fed’s battle against inflation has made significant progress, helping push consumer price increases down from 9.1% in June of 2022, to a range of 3% to 4% over the past few months. However, that is still above the Fed’s goal of 2%, a fact that calls into question whether the central bank will cut rates this year or stand pat. Based on their public comments, Fed officials appear biased toward cutting.

Inflation is declining around the world, but does it justify rate cuts?

Fed Chair Jerome Powell has identified two paths to rate cuts: unexpected weakness in the labor market or inflation moving sustainably down to 2%. As Powell often states, Fed policy remains “data dependent.”

Atluri is optimistic that price increases will fall closer to the Fed’s target in the second half of this year. That’s largely because rent increases — a major reason core inflation remains elevated — continue to modestly improve.

Elsewhere in the world, growth and inflation expectations are weaker than in the U.S., and central banks are expected to cut interest rates more rapidly. Europe is struggling with economic growth below 1%. China’s economy, hit by a major downturn in the real estate market, is showing signs of additional weakness as the world’s second largest economy reaches a level of maturity after nearly 30 years of uninterrupted growth.

U.S. presidential election: The world is watching

Elections are taking place throughout the world this year, but none will be more closely watched than the November rematch between incumbent U.S. President Joe Biden and former President Donald Trump. The result could produce a significant shift in political leadership, potentially triggering policy changes that could affect the investment environment, both in the U.S. and globally.

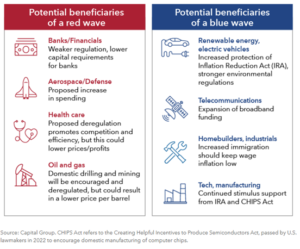

A great deal depends on whether the winning presidential candidate will muster enough support to propel other candidates in his party to victory, taking control of the U.S. Senate and the House of Representatives in a red wave or blue wave scenario. Otherwise, gridlock could prevail, with little change expected. However it plays out, investors should expect occasional bouts of market volatility in the months leading up to Election Day.

How U.S. elections could impact financial markets

A Republican sweep, or red wave, could benefit banks, health care companies, and oil and gas companies, primarily through deregulation, according to Capital Group’s Night Watch team, a group of economists, analysts and portfolio managers who track such issues. A Democratic sweep, or blue wave, could provide a boost to renewable energy initiatives, industrial stimulus spending and telecommunications projects through additional funding for nationwide broadband access. As for the presidential election, it remains too close to call. “We’re still a few months away,” says Capital Group political economist Matt Miller. “And that’s a lifetime in politics.”

Original Article: https://www.capitalgroup.com/advisor/insights/articles/2024-midyear-economic-outlook.html

Invest Well. Manage Well. Live Well.

Invest Well. Manage Well. Live Well. Gary is a Financial Associate at Gleba & Associates, Inc., joining our team in June 2020. After graduating from Walsh College with a Bachelor’s Degree in Finance in 2013, he began his career at Raymond James Financial Services. He then moved to the world of banking, working as a banker with Chase Private Client and then as an Assistant Vice President, Financial Advisor with PNC Investments. Gary has expertise in all aspects of financial planning including investment management, higher education planning, life insurance, and long-term care insurance needs analysis. When he gets away from the office, he loves to spend time with his wife, Lauren, and two daughters, Hadley and Harper. He enjoys woodworking, boating, summer weekends at the family cottage, spending time outdoors and traveling.

Gary is a Financial Associate at Gleba & Associates, Inc., joining our team in June 2020. After graduating from Walsh College with a Bachelor’s Degree in Finance in 2013, he began his career at Raymond James Financial Services. He then moved to the world of banking, working as a banker with Chase Private Client and then as an Assistant Vice President, Financial Advisor with PNC Investments. Gary has expertise in all aspects of financial planning including investment management, higher education planning, life insurance, and long-term care insurance needs analysis. When he gets away from the office, he loves to spend time with his wife, Lauren, and two daughters, Hadley and Harper. He enjoys woodworking, boating, summer weekends at the family cottage, spending time outdoors and traveling. Conor is a Financial Associate at Gleba & Associates, Inc., where he started in 2018. Conor has prior experience in the financial planning industry, as well as in the insurance industry. His high level of understanding insurance and financial products helps him in assessing the needs of our clients. He holds a Bachelor of Science degree in Business Administration with a concentration in Finance from the University of Detroit Mercy. You can often find Conor playing soccer or walking with his two dogs Milo, and Ellie. He is also an avid follower of the Detroit Tigers, Detroit Red Wings and his alma mater, the University of Detroit Mercy Titans.

Conor is a Financial Associate at Gleba & Associates, Inc., where he started in 2018. Conor has prior experience in the financial planning industry, as well as in the insurance industry. His high level of understanding insurance and financial products helps him in assessing the needs of our clients. He holds a Bachelor of Science degree in Business Administration with a concentration in Finance from the University of Detroit Mercy. You can often find Conor playing soccer or walking with his two dogs Milo, and Ellie. He is also an avid follower of the Detroit Tigers, Detroit Red Wings and his alma mater, the University of Detroit Mercy Titans. Lorie Heitzer is our Financial Associate at Gleba & Associates, Inc., where she has been a valuable employee for more than a decade! In her current role, Lorie assists with client reviews, implements client financial planning, and handles preparation of investment paperwork. During her time with Gleba & Associates, Lorie has earned her Series 6 (Investment Company Variable Contracts Representative), 63 (Uniform Securities Agent) and Life Insurance Licenses, allowing her to move into her current role where she assists clients in both of these areas. Lorie and her husband Bill, along with their daughters Lauren and Alexandria, and sons-in-law, Andrew & Joe, enjoy golf and make it a family event whenever possible. Her tenure at Gleba & Associates speaks volumes to her passion for the firm’s family atmosphere and her dedication to our clients and their financial and insurance needs.

Lorie Heitzer is our Financial Associate at Gleba & Associates, Inc., where she has been a valuable employee for more than a decade! In her current role, Lorie assists with client reviews, implements client financial planning, and handles preparation of investment paperwork. During her time with Gleba & Associates, Lorie has earned her Series 6 (Investment Company Variable Contracts Representative), 63 (Uniform Securities Agent) and Life Insurance Licenses, allowing her to move into her current role where she assists clients in both of these areas. Lorie and her husband Bill, along with their daughters Lauren and Alexandria, and sons-in-law, Andrew & Joe, enjoy golf and make it a family event whenever possible. Her tenure at Gleba & Associates speaks volumes to her passion for the firm’s family atmosphere and her dedication to our clients and their financial and insurance needs. Terri is the Service Manager at Gleba & Associates, Inc., Joining the team in April, 2015. In her role, she handles client service requests and underwriting. Terri’s previous experience in 401(k) Retirement Plans, Payroll and Human Resource Administration is invaluable, allowing Gleba & Associates to grow and run efficiently. This is knowledge that can also assist our small business clients as they grow their businesses. Terri enjoys spending time with family, which includes her husband, Gerry and her two children, Vincent and Genna. She loves the outdoors and camping with family in their RV. Terri looks forward to continuing the high level of customer service you have come to expect from Gleba & Associates!

Terri is the Service Manager at Gleba & Associates, Inc., Joining the team in April, 2015. In her role, she handles client service requests and underwriting. Terri’s previous experience in 401(k) Retirement Plans, Payroll and Human Resource Administration is invaluable, allowing Gleba & Associates to grow and run efficiently. This is knowledge that can also assist our small business clients as they grow their businesses. Terri enjoys spending time with family, which includes her husband, Gerry and her two children, Vincent and Genna. She loves the outdoors and camping with family in their RV. Terri looks forward to continuing the high level of customer service you have come to expect from Gleba & Associates! Michael is the Marketing Manager at Gleba & Associates, Inc., where he began in August 2017. In his position, Michael creates and develops marketing strategies to enhance the image of Gleba & Associates, and helps maximize the Client-Advisor relationship. He is also in charge of company events, seminars, and educational workshops. Michael has a Bachelor of Applied Arts Degree in Integrative Public Relations from Central Michigan University. When he is not in the office, Michael can most likely be found playing billiards, playing poker, on the tennis court, or rooting on the Utica Unicorns baseball team. Michael stays active by going to the gym and going to the dog park with his Labrador-mix, Milton. His approachable attitude, along with experience in marketing, communications, and social media, makes him a valuable asset to the Gleba & Associates team.

Michael is the Marketing Manager at Gleba & Associates, Inc., where he began in August 2017. In his position, Michael creates and develops marketing strategies to enhance the image of Gleba & Associates, and helps maximize the Client-Advisor relationship. He is also in charge of company events, seminars, and educational workshops. Michael has a Bachelor of Applied Arts Degree in Integrative Public Relations from Central Michigan University. When he is not in the office, Michael can most likely be found playing billiards, playing poker, on the tennis court, or rooting on the Utica Unicorns baseball team. Michael stays active by going to the gym and going to the dog park with his Labrador-mix, Milton. His approachable attitude, along with experience in marketing, communications, and social media, makes him a valuable asset to the Gleba & Associates team. Moiz is our Financial Associate at Gleba & Associates, Inc., where he began in 2013 after working for Bank of America and Thomson Reuters in various financial roles. In his position, Moiz assists in the research of financial solutions in order to meet client’s needs, conducts client reviews, provides insurance quotes, offers detailed financial plans, and delivers follow-up services to our clients. Before moving to the United States in 2004, Moiz grew up in rural India, where he was raised in a family of entrepreneurs. This allowed him to quickly learn the value of financial investment. Moiz holds a Bachelor of Commerce Degree in Accounting from Gujrat University and a B.B.A. in Management and an MBA from Walsh College of Accountancy and Business Administration, where he was elected as a member of Delta Mu Delta, the International Honor Society in Business Administration in recognition of high scholastic attainment. Moiz enjoys spending time with his wife, Tasneem, son, Taha, and family. He also loves playing tennis and rebuilding computers. His expertise in the areas of banking, mortgage and taxation helps to provide our clients with distinct portfolio advice as well as overall financial direction and growth.

Moiz is our Financial Associate at Gleba & Associates, Inc., where he began in 2013 after working for Bank of America and Thomson Reuters in various financial roles. In his position, Moiz assists in the research of financial solutions in order to meet client’s needs, conducts client reviews, provides insurance quotes, offers detailed financial plans, and delivers follow-up services to our clients. Before moving to the United States in 2004, Moiz grew up in rural India, where he was raised in a family of entrepreneurs. This allowed him to quickly learn the value of financial investment. Moiz holds a Bachelor of Commerce Degree in Accounting from Gujrat University and a B.B.A. in Management and an MBA from Walsh College of Accountancy and Business Administration, where he was elected as a member of Delta Mu Delta, the International Honor Society in Business Administration in recognition of high scholastic attainment. Moiz enjoys spending time with his wife, Tasneem, son, Taha, and family. He also loves playing tennis and rebuilding computers. His expertise in the areas of banking, mortgage and taxation helps to provide our clients with distinct portfolio advice as well as overall financial direction and growth.