Welcome to the Benjamin Button economy

September 26, 2024

Originally written by Jared Franz for Capital Group

In the 2008 movie, The Curious Case of Benjamin Button, the title character played by

Brad Pitt ages in reverse, transitioning over time from an old man to a young child.

Oddly enough, I think the U.S. economy is doing something similar.

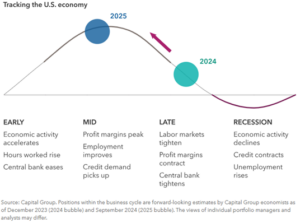

Instead of the typical four-stage business cycle — early, mid, late and recession — we

have witnessed since the end of World War II, the economy appears to be transitioning

from late-cycle characteristics of tight monetary policy and rising cost pressures back to

mid-cycle, where corporate profits tend to peak, credit demand picks up and monetary

policy is generally neutral.

The next step should have been recession but, in my view, we have clearly avoided that

painful part of the business cycle and essentially moved backward in economic time to a

healthier condition.

U.S. economy goes back to the future

How did this happen? Much like the movie, it’s a bit of a mystery, but I think the

Benjamin Button economy has resulted largely from post-pandemic distortions in the

U.S. labor market that were signaling late-cycle conditions. However, other broader

economic indicators that I think may be more reliable today are flashing mid-cycle.

If the U.S. economy is mid-cycle, as I believe, then we could be on the way to a multi-

year expansion period that may not produce a recession until 2028. In the past, this

type of economic environment has produced stock market returns in the range of 14% a

year and provided generally favorable conditions for bonds.

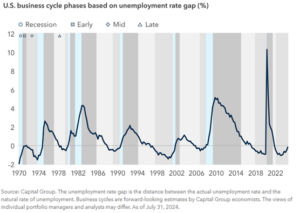

The unemployment rate gap

Stay with me for a moment while I explain my methodology. Instead of using standard

unemployment figures to determine business cycle stages, I prefer to look at the

unemployment rate gap. That’s the gap between the actual unemployment rate

(currently 4.2%) and the natural rate of unemployment, often referred to as the non-

accelerating inflation rate of unemployment, or NAIRU. That number typically falls in a

range from 5.0% to 6.0%. Simply put, it’s the level of unemployment below which

inflation would be expected to rise.

While this is a summary measure of dating the business cycle, it is based on a more

comprehensive approach that looks at monetary policy, cost pressures, corporate profit

margins, capital expenditures and overall economic output.

The unemployment gap is a measure that can be tracked each month with the release

of the U.S. employment report. The reason it has worked so well is because the various

gap stages tend to correlate with the underlying factors of each business cycle. For

example, when labor markets are tight, cost pressures tend to be high, corporate profits

fall and the economy tends to be late cycle.

Unemployment data signals rise of a mid-cycle economy

This approach also worked nicely in pre-pandemic times, providing an early warning

signal of late-cycle economic vulnerability in 2019. That was followed by the brief

COVID recession from February 2020 to April 2020.

It’s likely that the pandemic has distorted the U.S. labor market, structurally and

cyclically. For example, the labor force participation rate experienced an unprecedented

decline as global economic activity came to a virtual standstill. That was followed by a

remarkable rebound in the participation rate above pre-pandemic levels for prime-age

(25- to 54-year-old) workers.

In other words, traditional ways of looking at the unemployment picture are now less

useful tools for calibrating broader economic conditions. They've become less

correlated with classic business cycle dynamics. Not recognizing these changes can

lead to overly optimistic or overly pessimistic assessments of the cycle.

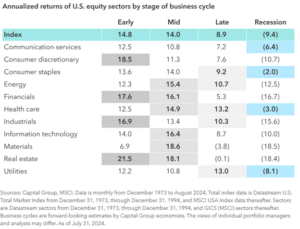

Market implications: Stocks and bonds could do well

My macroeconomic view drives my equity market view. As I said, an economy that is

mid-cycle has tended to produce equity returns of approximately 14% on an annualized

basis. Small-cap stocks have generally outpaced large caps, value has outpaced

growth, and the materials and real estate sectors have generated the best returns.

These figures are based on a Capital Group assessment of market returns from

December 1973 to August 2024.

As always, it’s important to acknowledge that past results are not reflective of results in

future periods. But if the U.S. economy continues to grow at a healthy rate — 2.5% to

3.0% in my estimation — that should provide a nice tailwind for equity prices. Over long

periods of time, when the U.S. economy grows above its potential 2.0% growth rate,

that type of environment has generally supported better-than-average stock market

returns.

A mid-cycle economy has provided favorable market returns

Mid-cycle economies have also generally produced a favorable backdrop for fixed

income markets. During the same period referenced above, long-term U.S. government

bonds returned 4.7% on an annualized basis, while long-term corporate bonds returned

5.0%.

If the Fed continues to cut interest rates, I believe that could provide an even more

favorable environment for bonds over the next few years. Given my positive economic

outlook, I don’t think the Fed will reduce rates as much as the market expects. Inflation

hasn’t been defeated quite yet. It’s still slightly above the Fed’s 2% target, so following

last week’s 50 basis point cut, I think central bank officials will be cautious about future

rate cut actions.

Election uncertainty? Not really

With U.S. elections about a month away, you may be wondering if my outlook for the

economy and markets will change depending on the outcome. The answer is no. Over

the years, I’ve learned to be election agnostic. Promises made on the campaign trail

often look nothing like the policies enacted after Election Day and, therefore, I generally

avoid taking political considerations into account.

As an economist, I believe political gridlock is not all bad, and it has tended to be the

norm in recent decades. I think we are likely to see a split government again in 2025,

with neither party gaining full control of the White House, the Senate and the House of

Representatives. That should narrow the potential for wild policy swings and put the

focus back on the fundamentals: the economy, the consumer and corporate earnings.

Original article:

https://www.capitalgroup.com/advisor/insights/articles/welcome-benjamin-button-economy.html

Invest Well. Manage Well. Live Well.

Invest Well. Manage Well. Live Well. Gary is a Financial Associate at Gleba & Associates, Inc., joining our team in June 2020. After graduating from Walsh College with a Bachelor’s Degree in Finance in 2013, he began his career at Raymond James Financial Services. He then moved to the world of banking, working as a banker with Chase Private Client and then as an Assistant Vice President, Financial Advisor with PNC Investments. Gary has expertise in all aspects of financial planning including investment management, higher education planning, life insurance, and long-term care insurance needs analysis. When he gets away from the office, he loves to spend time with his wife, Lauren, and two daughters, Hadley and Harper. He enjoys woodworking, boating, summer weekends at the family cottage, spending time outdoors and traveling.

Gary is a Financial Associate at Gleba & Associates, Inc., joining our team in June 2020. After graduating from Walsh College with a Bachelor’s Degree in Finance in 2013, he began his career at Raymond James Financial Services. He then moved to the world of banking, working as a banker with Chase Private Client and then as an Assistant Vice President, Financial Advisor with PNC Investments. Gary has expertise in all aspects of financial planning including investment management, higher education planning, life insurance, and long-term care insurance needs analysis. When he gets away from the office, he loves to spend time with his wife, Lauren, and two daughters, Hadley and Harper. He enjoys woodworking, boating, summer weekends at the family cottage, spending time outdoors and traveling. Conor is a Financial Associate at Gleba & Associates, Inc., where he started in 2018. Conor has prior experience in the financial planning industry, as well as in the insurance industry. His high level of understanding insurance and financial products helps him in assessing the needs of our clients. He holds a Bachelor of Science degree in Business Administration with a concentration in Finance from the University of Detroit Mercy. You can often find Conor playing soccer or walking with his two dogs Milo, and Ellie. He is also an avid follower of the Detroit Tigers, Detroit Red Wings and his alma mater, the University of Detroit Mercy Titans.

Conor is a Financial Associate at Gleba & Associates, Inc., where he started in 2018. Conor has prior experience in the financial planning industry, as well as in the insurance industry. His high level of understanding insurance and financial products helps him in assessing the needs of our clients. He holds a Bachelor of Science degree in Business Administration with a concentration in Finance from the University of Detroit Mercy. You can often find Conor playing soccer or walking with his two dogs Milo, and Ellie. He is also an avid follower of the Detroit Tigers, Detroit Red Wings and his alma mater, the University of Detroit Mercy Titans. Lorie Heitzer is our Financial Associate at Gleba & Associates, Inc., where she has been a valuable employee for more than a decade! In her current role, Lorie assists with client reviews, implements client financial planning, and handles preparation of investment paperwork. During her time with Gleba & Associates, Lorie has earned her Series 6 (Investment Company Variable Contracts Representative), 63 (Uniform Securities Agent) and Life Insurance Licenses, allowing her to move into her current role where she assists clients in both of these areas. Lorie and her husband Bill, along with their daughters Lauren and Alexandria, and sons-in-law, Andrew & Joe, enjoy golf and make it a family event whenever possible. Her tenure at Gleba & Associates speaks volumes to her passion for the firm’s family atmosphere and her dedication to our clients and their financial and insurance needs.

Lorie Heitzer is our Financial Associate at Gleba & Associates, Inc., where she has been a valuable employee for more than a decade! In her current role, Lorie assists with client reviews, implements client financial planning, and handles preparation of investment paperwork. During her time with Gleba & Associates, Lorie has earned her Series 6 (Investment Company Variable Contracts Representative), 63 (Uniform Securities Agent) and Life Insurance Licenses, allowing her to move into her current role where she assists clients in both of these areas. Lorie and her husband Bill, along with their daughters Lauren and Alexandria, and sons-in-law, Andrew & Joe, enjoy golf and make it a family event whenever possible. Her tenure at Gleba & Associates speaks volumes to her passion for the firm’s family atmosphere and her dedication to our clients and their financial and insurance needs. Terri is the Service Manager at Gleba & Associates, Inc., Joining the team in April, 2015. In her role, she handles client service requests and underwriting. Terri’s previous experience in 401(k) Retirement Plans, Payroll and Human Resource Administration is invaluable, allowing Gleba & Associates to grow and run efficiently. This is knowledge that can also assist our small business clients as they grow their businesses. Terri enjoys spending time with family, which includes her husband, Gerry and her two children, Vincent and Genna. She loves the outdoors and camping with family in their RV. Terri looks forward to continuing the high level of customer service you have come to expect from Gleba & Associates!

Terri is the Service Manager at Gleba & Associates, Inc., Joining the team in April, 2015. In her role, she handles client service requests and underwriting. Terri’s previous experience in 401(k) Retirement Plans, Payroll and Human Resource Administration is invaluable, allowing Gleba & Associates to grow and run efficiently. This is knowledge that can also assist our small business clients as they grow their businesses. Terri enjoys spending time with family, which includes her husband, Gerry and her two children, Vincent and Genna. She loves the outdoors and camping with family in their RV. Terri looks forward to continuing the high level of customer service you have come to expect from Gleba & Associates! Michael is the Marketing Manager at Gleba & Associates, Inc., where he began in August 2017. In his position, Michael creates and develops marketing strategies to enhance the image of Gleba & Associates, and helps maximize the Client-Advisor relationship. He is also in charge of company events, seminars, and educational workshops. Michael has a Bachelor of Applied Arts Degree in Integrative Public Relations from Central Michigan University. When he is not in the office, Michael can most likely be found playing billiards, playing poker, on the tennis court, or rooting on the Utica Unicorns baseball team. Michael stays active by going to the gym and going to the dog park with his Labrador-mix, Milton. His approachable attitude, along with experience in marketing, communications, and social media, makes him a valuable asset to the Gleba & Associates team.

Michael is the Marketing Manager at Gleba & Associates, Inc., where he began in August 2017. In his position, Michael creates and develops marketing strategies to enhance the image of Gleba & Associates, and helps maximize the Client-Advisor relationship. He is also in charge of company events, seminars, and educational workshops. Michael has a Bachelor of Applied Arts Degree in Integrative Public Relations from Central Michigan University. When he is not in the office, Michael can most likely be found playing billiards, playing poker, on the tennis court, or rooting on the Utica Unicorns baseball team. Michael stays active by going to the gym and going to the dog park with his Labrador-mix, Milton. His approachable attitude, along with experience in marketing, communications, and social media, makes him a valuable asset to the Gleba & Associates team. Moiz is our Financial Associate at Gleba & Associates, Inc., where he began in 2013 after working for Bank of America and Thomson Reuters in various financial roles. In his position, Moiz assists in the research of financial solutions in order to meet client’s needs, conducts client reviews, provides insurance quotes, offers detailed financial plans, and delivers follow-up services to our clients. Before moving to the United States in 2004, Moiz grew up in rural India, where he was raised in a family of entrepreneurs. This allowed him to quickly learn the value of financial investment. Moiz holds a Bachelor of Commerce Degree in Accounting from Gujrat University and a B.B.A. in Management and an MBA from Walsh College of Accountancy and Business Administration, where he was elected as a member of Delta Mu Delta, the International Honor Society in Business Administration in recognition of high scholastic attainment. Moiz enjoys spending time with his wife, Tasneem, son, Taha, and family. He also loves playing tennis and rebuilding computers. His expertise in the areas of banking, mortgage and taxation helps to provide our clients with distinct portfolio advice as well as overall financial direction and growth.

Moiz is our Financial Associate at Gleba & Associates, Inc., where he began in 2013 after working for Bank of America and Thomson Reuters in various financial roles. In his position, Moiz assists in the research of financial solutions in order to meet client’s needs, conducts client reviews, provides insurance quotes, offers detailed financial plans, and delivers follow-up services to our clients. Before moving to the United States in 2004, Moiz grew up in rural India, where he was raised in a family of entrepreneurs. This allowed him to quickly learn the value of financial investment. Moiz holds a Bachelor of Commerce Degree in Accounting from Gujrat University and a B.B.A. in Management and an MBA from Walsh College of Accountancy and Business Administration, where he was elected as a member of Delta Mu Delta, the International Honor Society in Business Administration in recognition of high scholastic attainment. Moiz enjoys spending time with his wife, Tasneem, son, Taha, and family. He also loves playing tennis and rebuilding computers. His expertise in the areas of banking, mortgage and taxation helps to provide our clients with distinct portfolio advice as well as overall financial direction and growth.