Edited for clarity and brevity by Gleba & Associates

Over the first quarter, inflationary pressures decelerated and global growth remained mixed.

- The global business cycle is less synchronized and faces multiple crosswinds.

- The U.S. is in the late-cycle expansion phase. Banking stress adds to the elevated odds of a recession in the coming quarters.

- China’s post-COVID reopening and policy stimulus support a continued recovery, but the magnitude and length remain uncertain.

- The rate of inflation is slowing, but persistent pressures imply greater economic slowing may be necessary to bring it down sustainably.

- The Fed is likely nearing the end of its hiking cycle, but global monetary tightening is dampening liquidity and adding to growth risks.

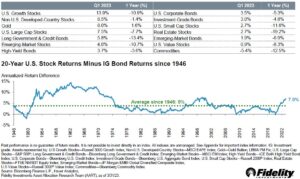

Asset prices fluctuated considerably during the first quarter but ended up posting their second consecutive quarter of widespread gains. A decline in U.S. Treasury yields helped boost both fixed income and equity returns, with gold, non-U.S. developed-market equities, and large cap growth stocks leading the way. Longer maturity bond categories posted the best fixed income gains, while commodity prices fell.

The MOVE Index, a measure of volatility in Treasury markets, spiked during the first quarter to its highest level on record outside of the global financial crisis of 2008-2009. Banking sector turmoil and dramatic fluctuations in investor views of the outlook for inflation and monetary policy contributed to the volatility. In contrast, measures of equity-market volatility, such as the VIX index, remained relatively range-bound.

Aggressive monetary tightening by the world’s major central banks continued during the first quarter, bringing global short-term interest rates to their highest levels in more than a decade. Most investors expect the pace of rate hikes to slow and eventually stop over the next two quarters, but the impact of the abrupt departure from the ultra-low rates era may weight on financial conditions in the quarters to come.

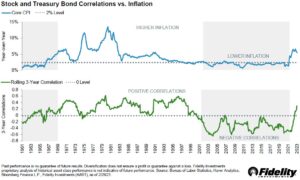

Over the past 20 years, subdued U.S. core inflation averaged about 2% and facilitated an environment of negative correlations between U.S. stock and Treasury bonds, leading to strong portfolio diversification. Since 2021, the backdrop has been more akin to prior periods of high inflation and positive stock-bond correlations, where the performance of stocks and bonds moved in the same direction.

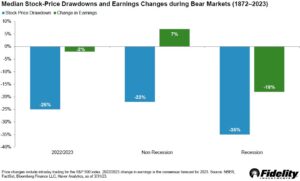

Historically, most bear markets for stocks (declines of 20% or more) coincide with recessionary contractions in the economy and corporate profits. Sometimes bear markets occur without a recession, typically with positive earnings growth and less stock-price declines. Since the start of 2022, stock prices and earning forecasts have been somewhere in the range between historical recession and non-recession bear markets.

Nominal 10-year Treasury bond yields declined during the first quarter, driven by a decrease in real yields – the inflation-adjusted cost of borrowing. However, both nominal and real yields remained at the upper end of their ranges over the past decade, supported by the Fed’s monetary tightening. Inflation expectations did not change much by the end of the first quarter and have remained relatively steady over the past few quarters.

If you have any questions about the current market, or anything else, you can always contact us by giving us a call at (248) 879-4510 or sending an email to info@GlebaAndAssociates.com.

Diversification does not ensure a profit or guarantee against loss. Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Adviser. Gleba & Associates and Cambridge are not affiliated.

Information from: https://institutional.fidelity.com/app/literature/item/9880898.html

Invest Well. Manage Well. Live Well.

Invest Well. Manage Well. Live Well. Gary is a Financial Associate at Gleba & Associates, Inc., joining our team in June 2020. After graduating from Walsh College with a Bachelor’s Degree in Finance in 2013, he began his career at Raymond James Financial Services. He then moved to the world of banking, working as a banker with Chase Private Client and then as an Assistant Vice President, Financial Advisor with PNC Investments. Gary has expertise in all aspects of financial planning including investment management, higher education planning, life insurance, and long-term care insurance needs analysis. When he gets away from the office, he loves to spend time with his wife, Lauren, and two daughters, Hadley and Harper. He enjoys woodworking, boating, summer weekends at the family cottage, spending time outdoors and traveling.

Gary is a Financial Associate at Gleba & Associates, Inc., joining our team in June 2020. After graduating from Walsh College with a Bachelor’s Degree in Finance in 2013, he began his career at Raymond James Financial Services. He then moved to the world of banking, working as a banker with Chase Private Client and then as an Assistant Vice President, Financial Advisor with PNC Investments. Gary has expertise in all aspects of financial planning including investment management, higher education planning, life insurance, and long-term care insurance needs analysis. When he gets away from the office, he loves to spend time with his wife, Lauren, and two daughters, Hadley and Harper. He enjoys woodworking, boating, summer weekends at the family cottage, spending time outdoors and traveling. Conor is a Financial Associate at Gleba & Associates, Inc., where he started in 2018. Conor has prior experience in the financial planning industry, as well as in the insurance industry. His high level of understanding insurance and financial products helps him in assessing the needs of our clients. He holds a Bachelor of Science degree in Business Administration with a concentration in Finance from the University of Detroit Mercy. You can often find Conor playing soccer or walking with his two dogs Milo, and Ellie. He is also an avid follower of the Detroit Tigers, Detroit Red Wings and his alma mater, the University of Detroit Mercy Titans.

Conor is a Financial Associate at Gleba & Associates, Inc., where he started in 2018. Conor has prior experience in the financial planning industry, as well as in the insurance industry. His high level of understanding insurance and financial products helps him in assessing the needs of our clients. He holds a Bachelor of Science degree in Business Administration with a concentration in Finance from the University of Detroit Mercy. You can often find Conor playing soccer or walking with his two dogs Milo, and Ellie. He is also an avid follower of the Detroit Tigers, Detroit Red Wings and his alma mater, the University of Detroit Mercy Titans. Lorie Heitzer is our Financial Associate at Gleba & Associates, Inc., where she has been a valuable employee for more than a decade! In her current role, Lorie assists with client reviews, implements client financial planning, and handles preparation of investment paperwork. During her time with Gleba & Associates, Lorie has earned her Series 6 (Investment Company Variable Contracts Representative), 63 (Uniform Securities Agent) and Life Insurance Licenses, allowing her to move into her current role where she assists clients in both of these areas. Lorie and her husband Bill, along with their daughters Lauren and Alexandria, and sons-in-law, Andrew & Joe, enjoy golf and make it a family event whenever possible. Her tenure at Gleba & Associates speaks volumes to her passion for the firm’s family atmosphere and her dedication to our clients and their financial and insurance needs.

Lorie Heitzer is our Financial Associate at Gleba & Associates, Inc., where she has been a valuable employee for more than a decade! In her current role, Lorie assists with client reviews, implements client financial planning, and handles preparation of investment paperwork. During her time with Gleba & Associates, Lorie has earned her Series 6 (Investment Company Variable Contracts Representative), 63 (Uniform Securities Agent) and Life Insurance Licenses, allowing her to move into her current role where she assists clients in both of these areas. Lorie and her husband Bill, along with their daughters Lauren and Alexandria, and sons-in-law, Andrew & Joe, enjoy golf and make it a family event whenever possible. Her tenure at Gleba & Associates speaks volumes to her passion for the firm’s family atmosphere and her dedication to our clients and their financial and insurance needs. Terri is the Service Manager at Gleba & Associates, Inc., Joining the team in April, 2015. In her role, she handles client service requests and underwriting. Terri’s previous experience in 401(k) Retirement Plans, Payroll and Human Resource Administration is invaluable, allowing Gleba & Associates to grow and run efficiently. This is knowledge that can also assist our small business clients as they grow their businesses. Terri enjoys spending time with family, which includes her husband, Gerry and her two children, Vincent and Genna. She loves the outdoors and camping with family in their RV. Terri looks forward to continuing the high level of customer service you have come to expect from Gleba & Associates!

Terri is the Service Manager at Gleba & Associates, Inc., Joining the team in April, 2015. In her role, she handles client service requests and underwriting. Terri’s previous experience in 401(k) Retirement Plans, Payroll and Human Resource Administration is invaluable, allowing Gleba & Associates to grow and run efficiently. This is knowledge that can also assist our small business clients as they grow their businesses. Terri enjoys spending time with family, which includes her husband, Gerry and her two children, Vincent and Genna. She loves the outdoors and camping with family in their RV. Terri looks forward to continuing the high level of customer service you have come to expect from Gleba & Associates! Michael is the Marketing Manager at Gleba & Associates, Inc., where he began in August 2017. In his position, Michael creates and develops marketing strategies to enhance the image of Gleba & Associates, and helps maximize the Client-Advisor relationship. He is also in charge of company events, seminars, and educational workshops. Michael has a Bachelor of Applied Arts Degree in Integrative Public Relations from Central Michigan University. When he is not in the office, Michael can most likely be found playing billiards, playing poker, on the tennis court, or rooting on the Utica Unicorns baseball team. Michael stays active by going to the gym and going to the dog park with his Labrador-mix, Milton. His approachable attitude, along with experience in marketing, communications, and social media, makes him a valuable asset to the Gleba & Associates team.

Michael is the Marketing Manager at Gleba & Associates, Inc., where he began in August 2017. In his position, Michael creates and develops marketing strategies to enhance the image of Gleba & Associates, and helps maximize the Client-Advisor relationship. He is also in charge of company events, seminars, and educational workshops. Michael has a Bachelor of Applied Arts Degree in Integrative Public Relations from Central Michigan University. When he is not in the office, Michael can most likely be found playing billiards, playing poker, on the tennis court, or rooting on the Utica Unicorns baseball team. Michael stays active by going to the gym and going to the dog park with his Labrador-mix, Milton. His approachable attitude, along with experience in marketing, communications, and social media, makes him a valuable asset to the Gleba & Associates team. Moiz is our Financial Associate at Gleba & Associates, Inc., where he began in 2013 after working for Bank of America and Thomson Reuters in various financial roles. In his position, Moiz assists in the research of financial solutions in order to meet client’s needs, conducts client reviews, provides insurance quotes, offers detailed financial plans, and delivers follow-up services to our clients. Before moving to the United States in 2004, Moiz grew up in rural India, where he was raised in a family of entrepreneurs. This allowed him to quickly learn the value of financial investment. Moiz holds a Bachelor of Commerce Degree in Accounting from Gujrat University and a B.B.A. in Management and an MBA from Walsh College of Accountancy and Business Administration, where he was elected as a member of Delta Mu Delta, the International Honor Society in Business Administration in recognition of high scholastic attainment. Moiz enjoys spending time with his wife, Tasneem, son, Taha, and family. He also loves playing tennis and rebuilding computers. His expertise in the areas of banking, mortgage and taxation helps to provide our clients with distinct portfolio advice as well as overall financial direction and growth.

Moiz is our Financial Associate at Gleba & Associates, Inc., where he began in 2013 after working for Bank of America and Thomson Reuters in various financial roles. In his position, Moiz assists in the research of financial solutions in order to meet client’s needs, conducts client reviews, provides insurance quotes, offers detailed financial plans, and delivers follow-up services to our clients. Before moving to the United States in 2004, Moiz grew up in rural India, where he was raised in a family of entrepreneurs. This allowed him to quickly learn the value of financial investment. Moiz holds a Bachelor of Commerce Degree in Accounting from Gujrat University and a B.B.A. in Management and an MBA from Walsh College of Accountancy and Business Administration, where he was elected as a member of Delta Mu Delta, the International Honor Society in Business Administration in recognition of high scholastic attainment. Moiz enjoys spending time with his wife, Tasneem, son, Taha, and family. He also loves playing tennis and rebuilding computers. His expertise in the areas of banking, mortgage and taxation helps to provide our clients with distinct portfolio advice as well as overall financial direction and growth.